Turkey’s Debt-Ridden Growth

Over the last decade, as the “great moderation” found its passage onto the path of “great recession” it would not be a mistake to portray the growth process of the Turkish economy as “a gradually-deflating balloon, subject to erratic and irregular moves”. Yet, if so, the real question becomes: what is the source of this speculative growth? (Or – if the readers will pardon my slangy expression what is the inflammatory gaseous source of this balloon?).

Weakening of the Link From Current Account Deficits to Growth

I would argue that a key distinguishing feature of the Turkish economy over this period was that the (positive) correlation between the growth rate and foreign savings (current account deficit) jumped to successfully higher thresholds in almost a permanent manner.

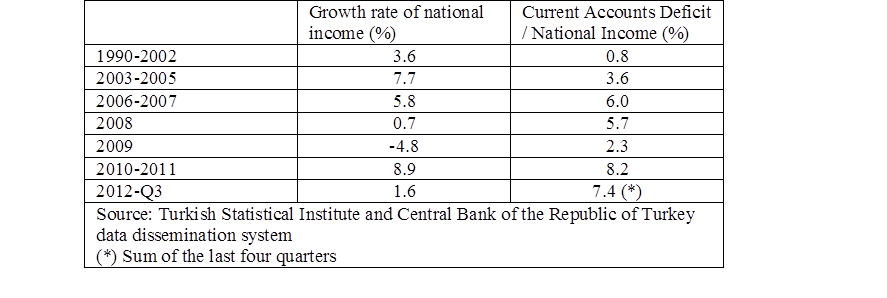

One should note that traditionally Turkey was not an economy generating high current account deficits. Observe for instance, that during the 1990s, the growth rate of national income was 3.6%, while the ratio of current account deficit to gross domestic product remained below 1%. Starting from 2003, annualized current deficit increased to the 3-4% band, and then jumped above 6% after 2006. In 2009, the growth rate, in parallel with the global recession, was (minus) 4.8 as the current deficit went down. However, then, in 2010, the ratio of current account deficit to national income restarted to increase. The data included in the Table 1 below exhibits these observations.

After 2006, Turkish economy has started to operate with a considerably high-rate (above 6%) of current account deficit in order to achieve positive growth. 2012 is the year when this observation has become clearer. In contrast to the “mild descent” scenarios as expected by the official bureaucracy and the international financial speculators, this period represents a new threshold in the process of transforming Turkish economy into a foreign debt-ridden economy presenting a heaven of cheap imports and labour surplus.

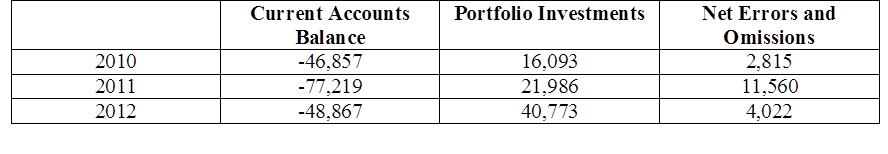

What is also alarming is the poor quality of the mode of financing of the aforementioned deficits. The following table encapsulates this issue.

It can be read from the data that 91% of the current account deficit for the year 2012, namely USD 48.8 billion, was financed by net inflows of portfolio investments and unrecorded capital inflows (so-called net errors and omissions). However, in retrospect, the percentage of the said-items in the current account deficit was around 40% in 2010 and 2011.

Being predicated on portfolio investments and unrecorded capital inflows, the hot money flows present the most volatile form of capital, which is also the most sensitive one to abrupt swings of foreign exchange speculation. These kinds of capital inflows, as created by hot money flows based on speculative incentives, account for the primary reasons responsible for excessive volatility and uncertainty in real sectors of the national economy.

Debt-Driven Accumulation

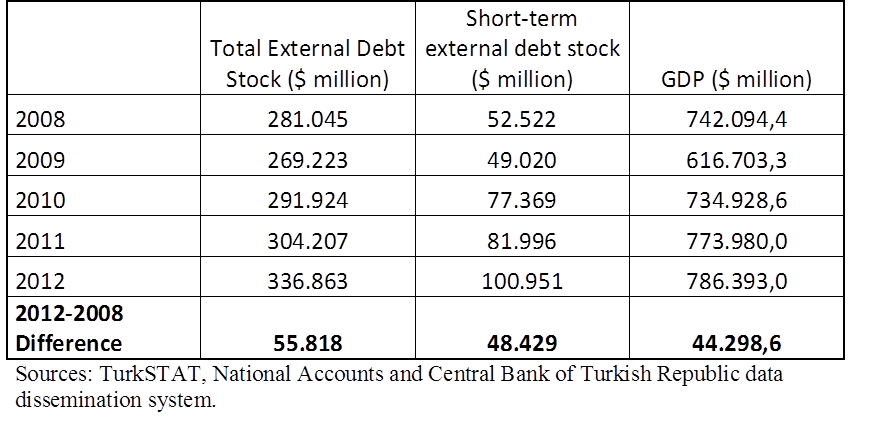

In 2008, Turkey’s national income, the gross domestic product (GDP), was USD 742.1 billion with a total external debt stock of USD 241 billion, USD 52.5 billion of which was composed of short term debt. Data presented in Table 3 indicate the Turkish economy’s external borrowing and growth adventure during the process of global great recession (2008 – 2012).

From 2008 to 2012, over the so-called great recession cycle, the Turkish economy has accumulated net extra external debt amounting to USD 55.8 billion in total. Over the course of the same period, Turkish gross domestic product has advanced to USD 786.4 billion with a cumulative increase of USD 44.3 billion. That’s to say, after 2008 the total net increase in external indebtedness was higher than that of the national income.

Another astonishing aspect of this growth miracle, which was running the Turkish economy into a debt trap at a dizzying speed, is that the external borrowing is mostly characterized by short-term structure. The net increase in short-term external debt stock, USD 48.4 billion, accounts for 87% of the overall increase.

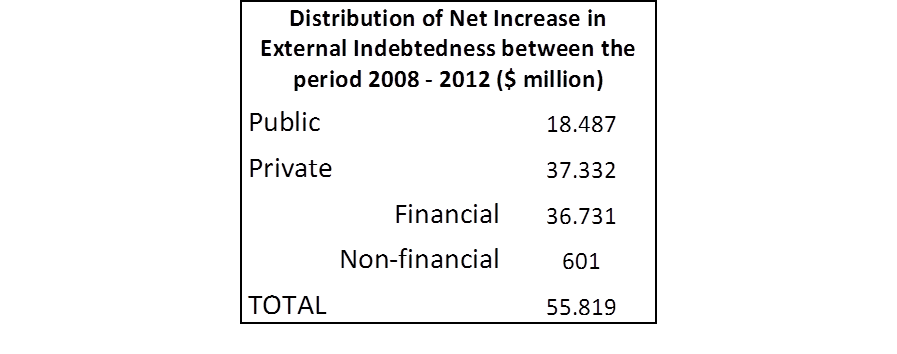

A related question is which agents (institutions) were the dominant sources of this episode. I know that a satisfactory answer to this question requires a more comprehensive analysis going far beyond the scope of this column, yet I believe that we can make comments about the overall tendency that we have derived from the official data. The official data show that out of the net increase of USD 55.8 billion in external indebtedness, USD 18.5 billion was generated by the public sector (including the Central Bank), while USD 37.3 billion was contracted by the private sector. Almost all of the private sector external debt was in turn concluded by the financial institutions. Only 1.6% (corresponding to USD 0.6 billion) of the net increase of USD 37.3 billion in private sector external indebtedness was generated by non-financial institutions.

However, the case was the exact opposite before 2008. Approximately two-thirds of the USD 100 billion net external debts accumulated by the Turkish private sector during the period 2003-2008 were accumulated by non-financial real economy sectors. Since the 2008/09 crisis, the real sector companies have seemingly declined using credit by way of external borrowing. Turkey has been, once again but much more severely, possessed by speculative fluctuations led by the risk appetite of the financial arbitrageours.

***

An economy, whose short-term external debt is increasing more rapidly than its national income… Rating agencies, whose recent decisions have been celebrated by the Turks as a matter of national pride, are undoubtedly familiar with these facts. Yet, one should not be naïve in matters of international political economy, and have a clear state of mind in that Turkey’s position in the new international division of labour is an extension of not only purely economical, but also political preferences of collective imperialism. The myths of “economic successes” are now ballooned via political elements.

Professor Erinç Yeldan, Dean, Faculty of Economics and Administrative Sciences, Yaşar University, İzmir

Please cite this publication as follows:

Yeldan, Erinç (May, 2013), “Turkey’s Debt-Ridden Growth”, Vol. II, Issue 3, pp.20-22, Centre for Policy and Research on Turkey (ResearchTurkey), London, ResearchTurkey. (http://researchturkey.org/dev/?p=3176)